Commencing the journey of acquiring your inaugural home in Liverpool is a thrilling milestone, albeit one that may initially seem overwhelming. To navigate the intricacies of home buying and the mortgage process with confidence, it’s important to comprehend the essential steps involved.

In this comprehensive article, our goal is to provide a detailed breakdown of the journey awaiting first time buyers in Liverpool. Additionally, we introduce the invaluable assistance offered by Liverpoolmoneyman. With our guidance, you’ll be well-prepared to initiate your homeownership journey.

For first time buyers in Liverpool, the journey commences with thorough research into the local housing market and a meticulous assessment of affordability.

Liverpool boasts diverse neighbourhoods, each with its unique character and property prices. Exploring various areas while considering amenities, transportation links, and nearby schools is essential for making informed decisions aligned with your preferences and budget.

Saving for a deposit is a pivotal step for first time buyers in Liverpool. The size of your deposit directly influences available mortgage options and interest rates.

Liverpoolmoneyman offers expert mortgage advice tailored to your needs, including insights on deposit-saving strategies. We guide you through government schemes like Shared Ownership, making homeownership more accessible.

Securing a mortgage marks a significant milestone, and Liverpoolmoneyman specialises in helping first time buyers in Liverpool in finding the right mortgage deals.

Our experienced mortgage advisors assess your financial circumstances, providing guidance on various mortgage options. They explain terms, interest rates, and repayment options, ensuring a clear understanding to make informed decisions aligned with your budget and goals.

With a mortgage agreement in principle secured, the next step involves the exciting search for your dream home in Liverpool. Utilise online property portals and local estate agents to explore available properties.

Property viewings offer a chance to immerse yourself in potential homes, envisioning your life there while considering key factors like proximity to amenities and future growth potential.

Upon finding the ideal property, the next step is making an offer to the seller, leading to the conveyancing process.

Liverpoolmoneyman recommends trustworthy solicitors or conveyancers to handle legal aspects, ensuring a smooth and thorough process. Their expertise provides assurance and peace of mind during this vital phase.

Arranging a survey and valuation for the intended property is essential for first time buyers in Liverpool. Professional surveyors assess the property’s condition, identifying potential issues.

The valuation report ensures the agreed price aligns with the property’s fair market value, key for making informed decisions and ensuring the property’s overall condition.

Post-survey, the focus shifts to finalising your mortgage application. Liverpoolmoneyman guides you through gathering required documents and submitting them to the mortgage lender.

Our dedicated team ensures a clear understanding of each step, aiming for a stress-free application process and successful mortgage approval.

After mortgage approval, the final steps involve exchanging contracts and completing the purchase. During the exchange, both parties commit to the transaction, with a specific completion date agreed upon.

On completion day, remaining funds are transferred, officially marking you as the proud owner of your new home in Liverpool.

Initiating your journey as a first time buyer in Liverpool is a blend of excitement and nerves. With Liverpoolmoneyman’s support, you can confidently navigate the home buying and mortgage process.

Our seasoned mortgage advisors specialise in guiding first-time buyers through the entire journey, covering key aspects from saving for a deposit to securing the dream home.

Reach out to Liverpoolmoneyman today and take the first step towards realising your homeownership dreams in Liverpool.

As a mortgage broker in Liverpool, we have come across many different applicants who ask the question “what is an agreement in principle?”. We feel like people ask this question as there are a lot of different variations of an agreement in principle.

You will have heard agreement in principle, mortgage in principle and decision in principle. In fact, these are all exactly the same!

But how do they work? What is an agreement in principle? This article covers these questions and why an agreement in principle is essential during the start of your mortgage journey.

A mortgage agreement in principle or AIP is a formal agreement between the buyer and the lender stating that the buyer is able to borrow from them. This agreement is reliant on evidential documents that can back up income and affordability.

Having an agreement in principle in place also shows that you have passed a lender’s credit check. Whether they perform a hard or soft credit search is down to the lender.

An agreement in principle is needed to be able to make an offer on a property. At the point of making an offer, the estate agent will likely ask you whether or not you have one in place.

Sometimes, an agreement in principle can help you negotiate the asking price. If you are a first time buyer in Liverpool, it could be really useful to try and get the price lowered by a small amount.

If you have an agreement in principle in place, the seller will know that you are serious about your purchase and you have the funds to proceed.

Some agreements in principle can affect your credit score. This is down to the credit search that lenders carry out.

Lenders will usually opt for soft credit searches, which will mean that your credit is unaffected. However, if they choose to perform a hard credit search, if something bad appears on your file, it could adversely affect your credit score.

If nothing appears on your file, an occasional hard credit check on your file should not harm your credit. When several hard checks are made, things can start to negatively affect you.

No one will ever be guaranteed a mortgage, however, agreement in principle may be able to increase your chances of getting accepted now.

With your agreement in principle, you will need to supply documents that evidence your income and affordability. Lenders will need to see your ID, bank statements, P60, payslips and proof of deposit before accepting your application.

If you are self employed in Liverpool, you may need to supply slightly more things.

Yes, you can, however, it may take slightly longer to get approved as you have no written agreement between yourself and the lender.

An agreement in principle can take as little as 24 hours to come through. As a mortgage broker in Liverpool, we are able to get this to you within 24 hours of your free mortgage appointment. It’s that easy!

Typically, your AIP will last between 30-90 days and if it expires before you proceed with a property purchase, don’t panic, it can easily be renewed! Just get in touch with one of our mortgage advisors in Liverpool.

We recommend obtaining an agreement in principle as early in the process as possible. This way, you can avoid the disappointment of being let down or declined for a mortgage.

Speak to one of our team members to get your process started and receive a free mortgage appointment online.

Once you have made a start on your home buying journey and have been able to save up a suitable deposit, it’s time for you to take the next step, which is for you to get prepared for your mortgage!

Below we have put together a detailed list of some helpful tips and tricks that could help first time buyers in Liverpool to make sure that they are “mortgage ready”.

Before you get in touch with a mortgage broker in Liverpool, before you do anything else, we would recommend that you look to get yourself an up-to-date credit report.

We would definitely recommend that you pay off any outstanding payments that are in your name, even if you have reasons for not doing so, such as a mobile phone bill dispute. Whilst you might not like to do so, it will put you in a much better position credit wise.

With less going against you financially, the mortgage lender will see you more favourably. We also suggest checking to make sure that you are on the voters roll, or that your information is correct. It may not seem hugely important at first, but it can have a big impact on your credit score!

Another way to improve your credit score is to close down any old or unused credit cards, though conversely, having a couple of cards you still use and pay off fully can work in your favour as well.w

Your mortgage advisor in Liverpool will be able to go through your credit report with you early on in your mortgage journey. You’ll receive expert mortgage advice in Liverpool on any ways that they feel you could work on improving your credit score.

In the early days of your home buying process, your mortgage advisor in Liverpool will ask you to provide photo ID. We usually find that this is in the form of either a driving license or passport.

Your driving license is also usable when it comes to your proof of address as well, though if you use this for that purpose, it cannot be used for proof of ID. This means, if you are using this for proof of photo ID, you’ll need something else to show your address.

Any non-UK nationals now residing in the UK will also need to show us a copy of their Visa.

You will also need to provide your mortgage advisor with documents that can prove to a mortgage lender where you live. We normally find that customers send in utility bills or original bank statements that are dated within the last 3 months.

Alternatively, however, as we mentioned above, if you are using a passport for your photo ID, you are welcome to use a driving license instead as a proof of your address.

Your bank statements should be able to demonstrate both your income and your outgoings. We would definitely recommend that customers try to stay away from partaking in any gambling on the build up to this, as the mortgage lenders may potentially hold this against you during your mortgage application.

It is also very important to make sure that you don’t go past any overdraft limits and let any direct debits bounce that are in your name. You absolutely need to be prepared ahead of time for this.

You will find that most mortgage lenders will be wanting to see your bank statements, as they like to be certain that you will definitely be able to maintain your monthly mortgage repayments.

As a first time buyer in Liverpool, you will also be required to prove to the mortgage lender that you also do in fact have the means to afford an initial deposit, keep up all of your payments and be able to evidence that you can do this, for anti-money laundering purposes.

Audit trails can be a little difficult to prove, especially if money has been moved back and forth between different accounts. As such, we would definitely advise keeping this to a minimum, if you are able to, as not to confuse the trail.

In truth, mortgage lenders would likely much rather prefer to see you building up your savings over time. If you have any large amounts going in, make sure you are able to account for those with receipts to evidence where those funds came from.

In recent years, we have found that a large amount of our customers deposits are actually gifted by family members. This is especially a popular choice for first time buyers in Liverpool, as it helps them to take that primary step onto the property ladder.

Gifted deposits will also always need to be evidenced, with the donor, the person who is gifting you the deposit, having a requirement to fill in a form that confirms it is purely a gift, not a loan that they expect you to repay.

Staying on topic with proof, you will also be required to provide proof of income. If you’re a standard, employed applicant, then this will typically be shown your last 3 months of payslips, with a portion of mortgage lenders out there needing to see your most recent P60.

A mortgage lender may also factor in any regular overtime, shift allowance, bonuses and commission that you have. If you have multiple employers, perhaps you are working a part-time job or are self employed and have contracts, a mortgage lender will sometimes accept your earnings from those as well.

We tend to find that a large amount applicants who are self employed will enquire for expert mortgage advice in Liverpool. If you are self employed in Liverpool and looking to apply for a mortgage, you will need help from your accountant to request your last 2-3 years’ proof of earnings from the revenue.

Our team of dedicated and experienced mortgage advisors in Liverpool have the knowledge to sit and discuss this with you, instructing on how to navigate the online government gateway portal if required to do so.

It’s always within your best interests to make sure that you are always prepared ahead of time and write down an estimate of what you think your outgoings could look like once you factor in mortgage payments and general running costs.

This will help you work out costs such as council tax and utility bills, as well as anything you regularly spend your money on, such as your food and drinks shopping.

It will also help to give you a generalised estimate of how much disposable income you’ll have available, in order to cover the costs of your monthly mortgage payments.

As you can see from all of the points we have discussed, there can be a lot to think about when preparing for a mortgage, although with the help of a dedicated mortgage advice team in Liverpool, you’ll hopefully be in the best place for taking on the process.

Putting in the effort from the start, staying patient and being careful will hopefully increase the likelihood of you walking out of the mortgage process with your dream property to show for it.

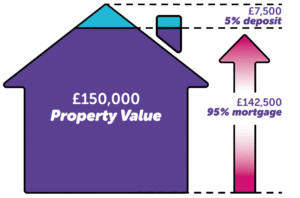

As the name would suggest, a 95% mortgage is where you are borrowing against 95% of the property price, paying the remaining 5% with your deposit. An example of this would be if you wanted to buy a property that was worth £150,000 with a 95% mortgage, your minimum deposit would be £7,500 and you would borrow the remaining £142,500 from the lender.

Following on from the March 2021 Budget, Prime Minister Boris Johnson announced a Mortgage Guarantee Scheme for mortgage lenders, something that would aim to make 95% mortgages more readily available from the high street banks.

This is very welcome news for First-Time Buyers and Home Movers, as this scheme will remain active until December 2022. Specific terms and conditions will apply, something your Mortgage Advisor in Liverpool will be able to look at with you, to see if you qualify.

All our customers who Get in Touch with us for Mortgage Advice in Liverpool, will receive a free, no-obligation mortgage consultation. Here, one of our dedicated mortgage advisors will be able to make a recommendation on the most appropriate route for you to take.

You will find that 95% mortgages are usually accessible by both First-Time Buyers in Liverpool & those who are Moving Home in Liverpool. The concept of saving for a 5% deposit sounds like a pretty straightforward plan of action, but you’ll still need to have an acceptable credit score and prove to the lender that you are able to afford your monthly mortgage repayments, before you are considered for a 95% mortgage.

You’ll need to demonstrate you have a good credit score before you’ll be accepted for any mortgage, especially a 95% mortgage. Handy tips for improving this will include paying any current credit commitments on time, ensuring your addresses are updated and checking that you’re on the voters roll. For a more detailed look at how and why you can help your credit score, please see our How to Improve Your Credit Score article.

Affordability is something else you should also consider. Providing the lender with enough details of your income and monthly outgoings (things like your bank statements will be necessary for this) and any pre-existing credit commitments will allow them to get a general overview of whether or not you are able to afford a 95% mortgage.

It’s a common occurrence these days to see lots of family members helping one another get onto the property ladder, especially with parents looking to further their children’s lives. This normally happens by a family member gifting the person looking to find their home, the deposit required to proceed. Known through the industry as the “Bank of Mum & Dad, Gifted Deposits should only be a gift, and not a loan to be paid back. The lender will need this to be agreed and proven, before it can be used towards your mortgage.

You always want to make sure you have the right type of mortgage, especially with something like a 95% mortgage. Each type works in its own way, with that choice allowing you to find one that is most appropriate for your personal and financial circumstances.

Some homeowners and buyers would rather go with a Fixed Rate or Tracker Mortgage, mortgage types which mean you either keep interest rates at a set amount or have your interest rates following the Bank of England base rates.

Alternatively, you might be more comfortable with the way Interest-Only or a Repayment Mortgages work. Interest-Only allows cheaper payments until you need to pay a lump sum once it reaches its end (mostly now used for Buy-to-Lets), whereas a Repayment mortgage (a normal mortgage if you’d like) means you’ll be paying a combination of both interest and capital per month.

You can read more about each of these mortgage types in our Different Types of Mortgages article, with informative videos for each type.

A mortgage is a hugely important financial outgoing, and as such you need to be prepared. If you aren’t prepared, you might find yourself more likely to be affected by things like higher interest rates, remortgaging difficulties due to less equity and then negative equity.

This is not something to worry about though, as these problems can be avoided if you’re smart enough with your process initially. The more deposit you put down, the less risk you’ll be to the lender.

A larger deposit would not only reduce the interest rates by a noticeable amount, but would also give the property more equity and reduce the risk of negative equity, which will be because you are borrowing less against the property.

So, whilst the risks may seem rather scary at first, planning ahead and saving for a larger deposit to access something like a 90% or even an 85% mortgage will be very beneficial in your mortgage journey and something you’ll be able to reap the rewards from in the future.

Today we live in an uncertain economic environment. Yet, in a world full of opportunities, therefore we like to be prepared, and when it comes to our finances, there is one thing we all desire: being well informed.

As a group of experts, we believe that there are some excellent reasons to use a mortgage broker in Liverpool, so here we will talk about both methods’ positives and negatives so that you can make the best well-informed decision.

We know that there are many mortgages options out there, for example, you can still go directly to the lender, whether via a branch or online. However, we discovered that most people still use a mortgage broker in Liverpool due to the benefits it brings.

You may not have much experience, but one thing is for sure: We all like to save some money. So, when we think of mortgage advice, one of the options that first comes to mind is to go directly to a Bank or Building Society, so that you won’t have to pay a broker fee. However, that option became unattractive when credit scores came in a few years ago, and people started looking for other alternatives.

Another of the mortgage products on the market are those offered by lenders that are only available directly. This strategy gets implemented to attract a fair business distribution from consumers and brokers alike. By being exclusive, they can turn on and off these products when they deem it necessary, this method often confuses the market and consumers.

However, from 2014 onwards, lenders were no longer allowed to sell mortgages without professional advice. Many consumers felt that non-advisors had been trying to push solid advice on them, and they weren’t able to benefit from some of the consumer protection. A benefit that accompanies sales conducted by professionally trained mortgage advisors is why most people still use this service.

Because of this, in late 2014, it was not unusual to have to wait more than a month just for an appointment, and it still happens today. Not the best scenario when you’ve just had your offer accepted on the house. So, many began to make their applications through mortgage agents, who assure you professionalism and a mortgage service the same day, like ourselves.

Another important point when applying for a mortgage is affordability, no matter how good the deal is if it is not enough money. That is why we believe that a broker is a perfect option. With our mortgage advice in Liverpool.

We can assure you of the best deal and our service when you need it, in a professional and personalized way. When you call us, we try and put you through with a qualified mortgage advisor either immediately or at the very least, within the same day (unless requested otherwise).

Applying for a mortgage can sometimes be difficult. Each case is unique, and many reasons can complicate an application. Some examples are:

• Poor credit history.

• Self-employed income.

• Mixed source of deposit (savings/gift).

• Let to Buy (keep your current home and buy another).

• Contract workers / zero-hour contracts.

• Affordability.

In previous years, lenders could stand out from the competition by merely offering a similar deal but better than another lender. In modern times this is very different, with lending criteria being what separates one lender from another.

However, as we mentioned before, when we talk about our well-being and finances, we like to be well informed and consult with experts on the subject. Your situation is unique, and what you need is not a better loan than someone else’s, but a better one for you and one that suits your situation.

That’s why we think that seeking professional mortgage advice in Liverpool is the best alternative. When you explain your position to an experienced mortgage broker in Liverpool, there is a chance they have come across something a little similar in the past, allowing them to personalize their service and help you through.

With a little luck, professionalism, and much work, your mortgage advisor will be able to recommend the most suitable mortgage for you at the lowest possible rate.

More than that, though, it’s not just about getting the mortgage. Even if the application itself is straightforward, our clients trust our experience and knowledge for more than that. For example, we will discuss how much they will offer for the property they are buying.

Our team of mortgage brokers in Liverpool can recommend other professional services such as solicitors and explain the different types of surveys and protection available to them.

Another significant advantage of using a mortgage broker is that they tend to be much more responsive than lenders might be. It’s not been unheard of for our team to work late at night, out of hours, working hard on client cases at full speed to ensure service is prompt, but also efficient. Our team is committed to offering our assistance when you need it and how you need it.

Another point that gets overlooked when looking at why clients may prefer a broker is that everyone is very busy. You may be self-employed in Liverpool, a full-time worker, a working mom and you need a mortgage but do not have time to do it, that is where your advisor can take the burden off for you.

Professional applicants especially see the benefits of these as they have clients of their own to charge for their services and appreciate the benefits of having an expert on board.

Technology is taking over, and the future of the mortgage market is no different. Perhaps in the future, we will see lenders who want to compete with the broker’s business. If this happens, they are unlikely to staff-up their branch networks.

Technology is excellent, and it is a service particular for customers who are happy to do business that way, especially for straightforward cases. However, for most people, there is an element of “reality,” a “human touch,” that you can’t get anywhere other than talking to a mortgage counsellor yourself.

The mortgage broker becomes your ally and can provide you with a satisfying experience, a complete service with all the benefits that the client requires and attention that technology cannot offer.

Having said all this, the reasons for hiring a mortgage broker in Liverpool are vast and if you want to ask any questions related to mortgages. Seek or obtain this service from the hand of a professional team adapted to your needs, get in touch, and we’ll put you through with a mortgage advisor in Liverpool as soon as possible.

Before you start your mortgage process, you should consider all of your options. Usually, customers are eager to get the whole thing over with as fast as possible. The most common mistake that customers make is rushing straight to a large estate agent and taking their in-house advice. We advise against this; in all honestly, you can get just as good and if not better advice elsewhere!

If you are a first time buyer in Liverpool, we strongly advise that you do your research and look around for external Mortgage Advisors in Liverpool that are more suited for your circumstances. On the other hand, if you do end up using in-house advisors, we have created a list of some sale tactics that estate agents use that you might find useful…

When you use your estate agent’s in-house Mortgage Advisor in Liverpool and their conveyancer, think about this… where has the money come from? The estate agents could be charging you extra on top of your other fees.

When you use a Mortgage Broker in Liverpool, you will get each and every cost broken down for you so that you can see exactly how your money has been spent. If you are unsure about anything whatsoever, it’s easy to ask and your question will be answered honestly. This is the personal touch of a Mortgage Broker in Liverpool.

On the rare occasion (as it’s illegal), estate agents may hold back your mortgage application just because you have used another financial advisor over theirs. For example, you could submit your application through a broker and then they could receive another application through their in-house system but then they could hold yours back to process their application first. Despite submitting your application first, you could end up being backlogged, even if your purchase is worth more than the other application! Remember to note that this is illegal.

If the estate agent is really trying their luck, they may try and charge you over the top in-house conveyancing fees. Even if your purchase is nice and straightforward, they could try and get an extra £1,500+ out of you for no reason. If this happens during your process, you should ask for a breakdown of where these extra costs are coming from.

There are plenty of other ways you can arrange a mortgage without using the estate agent. In this article we’ll cover the ways in which you can do so, helping you decide on who to use for your mortgage and getting the most out of your money.

If you would rather take matters into your own hands and get behind the wheel, you should know that it’s perfectly okay to do that! Everything that your advisor would arrange for you can be done online. Of course, you would be missing out on getting advice from a specialist, however, you would be avoiding the fee for getting the advice in the first place.

By using price comparison websites, you could end up finding yourself a great deal. You may also end up saving money down the line providing that you end up finding the right deal that suits your situation. Once you have your deal, you could end up getting through the process very quickly.

Here are some things to be aware of when switching your mortgage deal online:

Yes, it can be easy to make an appointment with your in-house advisor, however, is it your best option? Here are some things to take note of if you choose your in-house advisor:

Sometimes opting to use a Mortgage Broker in Liverpool, especially if you’ve been declined by your bank or are looking to access competitive mortgage rates. A Mortgage Broker has the potential to help you find a great deal, provide a personal service and get things completed quickly.

A Mortgage Broker in Liverpool will charge you for their services, however, they usually offer a free mortgage consultation up until the point where you send off your application.

At Liverpoolmoneyman Mortgage Brokers, we work solely for you and everything is kept strictly between us. We are also not tied to any estate agents, so we are free to access thousands of mortgage deals, it’s just the case of finding the right one for you!

Whether you are a first time buyer, moving home or looking to remortgage in Liverpool, you will find our mortgage advice service extremely beneficial. As a trusted Mortgage Broker in Liverpool, we will guide you through the home buying process, giving good, honest and unbiased mortgage advice. Get in touch for a free mortgage consultation and we’ll see how we’re able to help you.

We regularly receive questions from private tenants buying from landlords, often due to some landlords offering first refusal (the opportunity to buy before it hits the open market) to existing tenants. Even if you don’t have this privilege, it might still be an option and it is always worth asking your landlord if they would be willing to offer this to you in the event of a sale.

The government decided to crack down on tax relief previously available on buy to let mortgages in Liverpool. The changes were brought in over a 4-year period and it is only now this has taken effect that they are starting to see the impact of these changes as they receive their tax bills.

Property has been a solid means of income and a worthy investment for landlords over the years. Some landlords opted to ride out the tax changes because they are in it for the long haul, with a lengthy career as a landlord in mind.

However, some landlords were tempted to sell up and move on. There are lots of advantages on their part to selling you the property you currently reside in, which is why many of them took that route. Here are some of those:

There are also advantages for the sitting tenants buying from landlords in these kind of circumstances. Some are these are:

Gone are the days of someone leaving school at 18 and working for one employer all the way through to their eventual retirement. The rise in new engineering and digital occupations has, in particular, allowed for the popularity of self employed roles. But the uncertain nature of this type of work can make banks nervous.

If you are self employed in Liverpool, it’s not impossible to get a mortgage, though it certainly is considered a specialist area. So we will take the opportunity to help you get prepared if you’re thinking of buying a house whilst working as self employed.

Most lenders will only require a minimum of one year’s trading, with some lenders having stricter rules and wanting a minimum of two. The reason for this is that so many businesses fail within their first year and it’s a lot of risk that the banks aren’t willing to take.

Generally speaking, lenders will take the average of your last 2 years’ earning, however, there are some who go off the latest year. This could be very good news for you if your profits are on the increase.

This is a little trickier to answer. Technically yes, you are employed, however, unless you own less than 25% of the shares, the lender will not recognise you as an employee of the business. Most lenders add your salary to your declared dividend to calculate your annual earnings, with the occasional lender using net profit, something which can be good if your business retains some profit.

This is a question we hear regularly, but unfortunately, there’s not a lot we can do. Your mortgage application is assessed on the income that has been declared (net profit or salary/dividend) to the revenue. If you want to get a mortgage then you will have to have paid at least some tax.

No matter whether you’re a self-employed applicant or a standard employed applicant, this remains the same. You will need a minimum of 5% although it may be more than that if you only have one year’s accounts.

Putting down more deposit will likely open you up to a better deal than you otherwise would’ve had to choose from, and you will have a wider choice of lenders too. That being said, it doesn’t make any difference to the amount of mortgage you would be granted to borrow.

Admittedly, lenders do seem to like contractors a little more at certain times, especially if you’ve built up a good track record. With that, the lenders can consider taking your “daily rate” and applying a multiplier to this rather than your net profit. There have been lenders in the past who have offered bigger mortgages to contractor applicants using this method, especially for IT contractors.

Unfortunately, “self-certs” were widely abused by applicants in the pre-credit crunch days and there is no sign of this type of mortgage ever returning.

Taking out a self employed mortgage in Liverpool can certainly be more complicated than it would be for an standard employee, though some lenders may be more flexible than others when it comes to this.

That’s why It’s a good idea to speak with an experienced mortgage broker in Liverpool early on in the process. You’ll have realistic aspirations right from the start.

Long gone are the days when your bank manager could “take a view” on your circumstances just because you are a loyal customer. The lenders lean increasingly upon their computerised credit scoring systems and like lots of things, it’s just knowing where to look.

An Agreement in Principle (also referred to as an AIP), is a piece of documentation you are given once you pass the lenders credit score. You will need one of these if you wish to qualify for a mortgage.

Having an Agreement in Principle allows you to make an offer on a property you are interested in, as well as assisting when you want to negotiate on price, as it shows the seller you’re serious about your offer as a first time buyer in Liverpool.

The effects of an Agreement in Principle on your credit score, completely depend on whether the lender takes a hard credit search or a soft credit search. What are the differences between these? Below we’ll answer this.

Hard searches are more in-depth than soft searches. The main difference between hard and soft searches is that hard searches leave a footprint, which can negatively affect your credit score if you fail it too many times.

If you have a good credit score however, you shouldn’t need to worry going into this as a First Time Buyer in Liverpool.

The option you’re more likely to come across these days is that a lenders soft search. These are to hard searches, what a lite phone model is to the main release, usually requiring less information and in the majority cases leaving your credit score unaffected, even in the event of not passing.

Although an Agreement in Principle can be a massive help, it doesn’t always guarantee that you will successfully obtain a mortgage. The lender will still need you to provide them with documents in order for the underwriter to make their final decision.

You can usually find small print included on Agreements in Principle that may easily be missed. We find in some cases, when customers reach out for help about their Agreement in Principle, they’ve been turned away at full mortgage application stage.

The documents you will be required to provide can include; personal ID, payslips, bank statements and things of that ilk. As your dedicated Mortgage Broker in Liverpool, we take pride in helping our customers, whether Moving Home in Liverpool or Self Employed in Liverpool, get prepared for a mortgage.

You may be able to get away with this, however, most credible estate agents will want evidence that you are able to proceed with the purchase in question.

Your Agreement in Principle will usually need renewing after around 30-90 days, though this isn’t something you should worry about. The main reason we recommend getting one so early is to avoid being told the property you’re interested in is no longer available for purchase.

Getting your Agreement in Principle sorted also means you don’t just need to jump in and buy the first house you see. It’s a fairly easy process, so if it expires, we can quite easily help you get another one.

At the start of your mortgage process, you will soon realise that there are many different options available. If you are first time buyer in Liverpool, you are probably thinking “How could there be so many different types of mortgage?”

In this article we will provide a list of the most popular types of mortgages available on the market and hopefully answer any questions you have about them.

A fixed-rate mortgage means that your mortgage payments are not going to change for the length of your term. You are able to choose the length of this yourself, with common choices being 2, 3 or 5 years or longer. Regardless of what happens to inflation, interest rates or the economy, you have the security of knowing that your mortgage, likely your biggest outgoing payment each month, will remain the same.

A tracker mortgage means that your interest rate will track the base rate set by the Bank of England. What this means is, the lender that you are with does not actually choose the rate that will be applied, and you will be paying a percentage above the Bank of England base rate. In an example, if the base rate is 1% and you are tracking at 1% above base rate, you will be paying a rate of 2%.

When you take out a repayment mortgage this means that each month you are paying back a combination of both interest and capital. Providing that you keep your payments going for the full length of the mortgage term, you are almost guaranteed to have fully paid off the mortgage by the end of your term, resulting in the property becoming solely yours.

This is probably the most risk-free way to pay your capital back to the lender. Early on into your mortgage term, it is mainly the interest that you are paying and your balance will go down at a rather slow rate, especially if you have taken out a 25, 30 or 35-year term. The benefits of this arise in the last ten years or so of your mortgage, where your payments are covering more capital than interest and the balance will go down at a much quicker pace.

Whilst many Buy to Let Mortgages in Liverpool are set up on an interest-only basis, it is much harder task to get a residential property on that same basis.

The likelihood for lenders to offer an interest-only product now is a lot less than it was. That being said, there are certain circumstances where this can be a viable option, including things like downsizing later on in life, or having other investments what you will use to pay the capital back. Lenders have stricter rules when it comes to offering these products now and the loan to values are a lot lower than they used to be.

With an offset mortgage, the lender will set you up a savings account to work alongside your mortgage account. How this works is that, for example, if you have a mortgage balance of £100,000 and £20,000 is deposited into your savings account, you would only be paying interest on the difference, which in this case would be £80,000. This can be a much more efficient way of managing your money, especially if you pay a higher rate of tax.

Speak to an Advisor – It’s free!

7 Days a Week, 8am – 10pm